2025 Tax Brackets Married Filing Jointly

2025 Tax Brackets Married Filing Jointly. The standard deduction is the fixed amount the. Knowing your federal tax bracket is essential, as it determines your federal income tax rate for the year.

$94,050 for married couples filing jointly or for a qualifying surviving spouse. Publication 17 (2025), your federal income tax.

Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return.

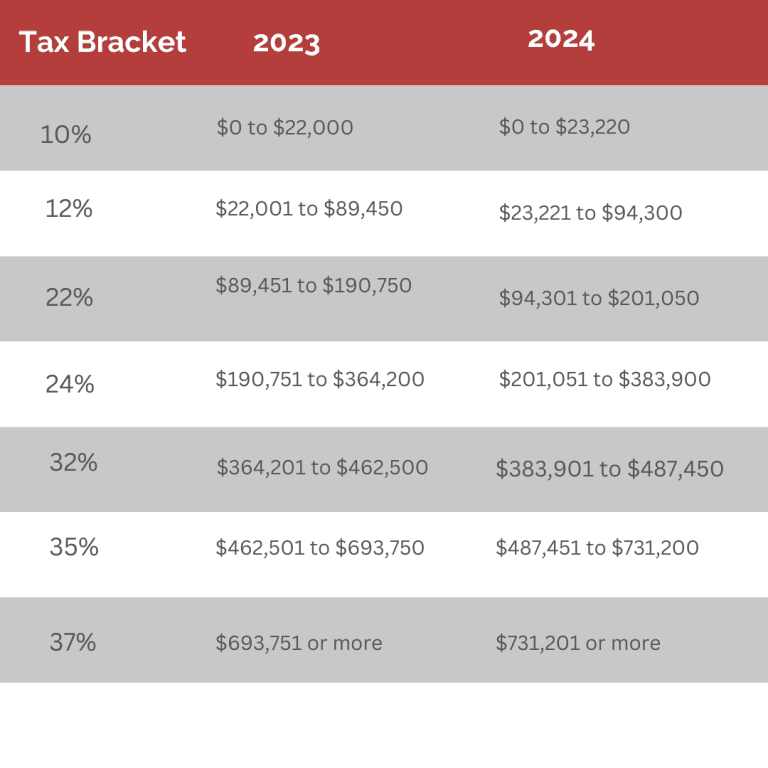

2025 Tax Brackets Married Filing Separately Married Gerta Juliana, Irs provides tax inflation adjustments for tax year 2025. There are seven different income tax rates:

Tax Brackets 2025 Married Jointly Lorie Corrinne, For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the 22% bracket for. Get updated on property taxes, income taxes, gas taxes, and more!

2025 Tax Brackets Announced What’s Different?, The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2025 tax year. The tax rate for individuals (single filing) earning under $400k will be preserved.

Tax Brackets 2025 Explained Usa Irena Leodora, The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2025 tax year. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

2025 Tax Brackets Married Filing Jointly Irs Shani Melessa, The tax rate for couples (joint filing) earning under $450k will be preserved. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100.

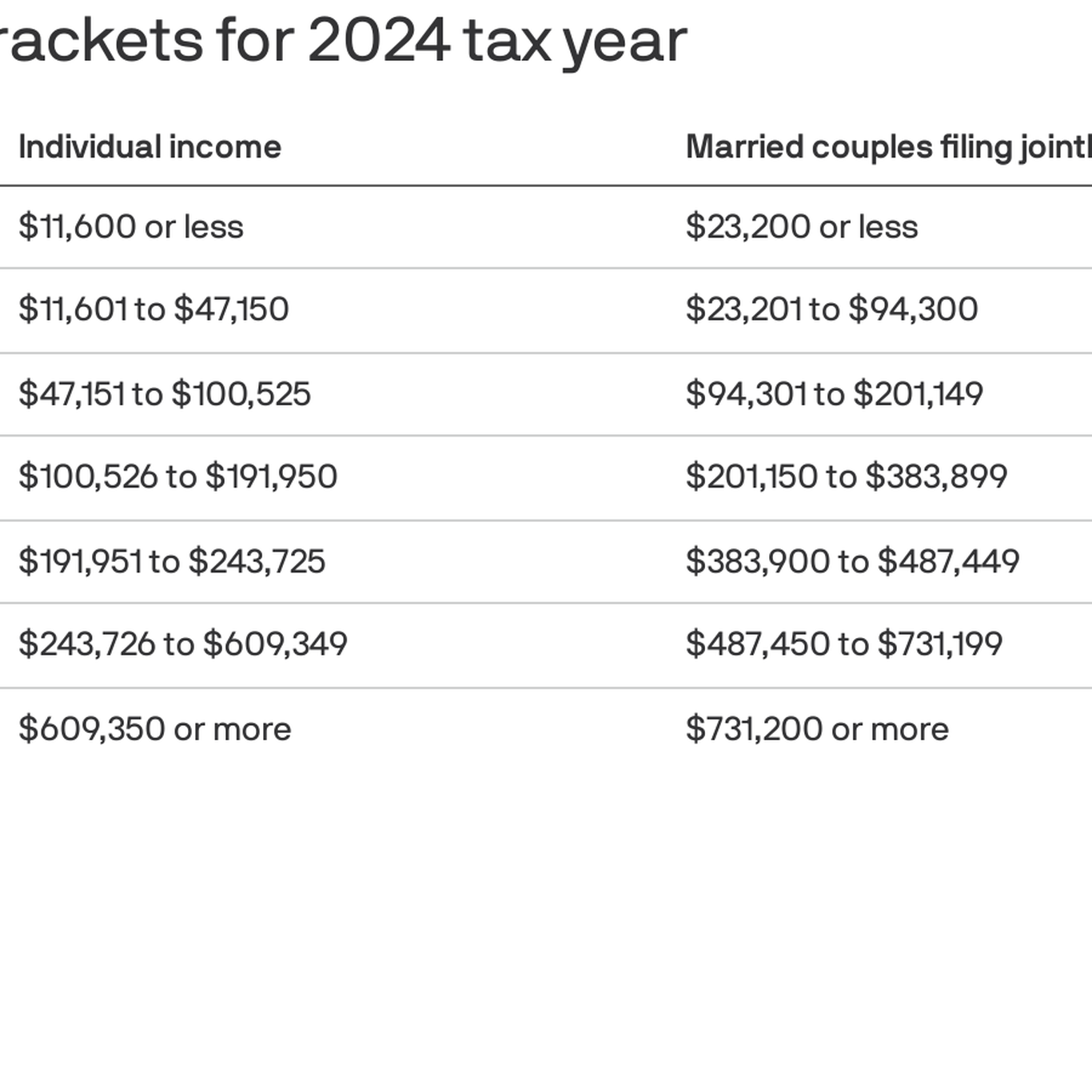

2025 Tax Rates And Brackets Married Filing Jointly Standard Deduction, Taxpayers whose net investment income exceeds the irs limit ($200,000 for an individual taxpayer, $250,000 married filing jointly, or $125,000 married filing. Married couples have the option of filing their tax returns jointly or separately, depending on which filing status suits their needs.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, Page last reviewed or updated: In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any.

Tax Bracket Changes 2025 For Single, Household, Married Filling, The tax rate for individuals (single filing) earning under $400k will be preserved. Page last reviewed or updated:

2025 Federal Standard Deduction For Married Filing Jointly Merla Stephie, Page last reviewed or updated: Single, married filing jointly, married filing separately or head of household.

2025 Irs Tax Brackets Married Filing Jointly Helen Kristen, $94,050 for married couples filing jointly or for a qualifying surviving spouse. If filing jointly as a married couple or a.

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Euro Cup 2025 Qualifiers Schedule Uk. From the group stage to the knockout rounds, find all of the official euro…

Top 10 Best Movies Of 2025 Bollywood. The misadventures of two young brides who get lost from the same train.…

Recent Photos Of Celine Dion 2025 And Lil. Celine dion was the final surprise of the 2025 grammy awards ceremony…